For the last 20 years, insurance companies operating in Nevada have been required to disclose their insured’s policy limit to Plaintiff’s attorneys if certain conditions are met. However, Nevada’s 2015 legislature repealed NRS 690B.042 altogether. Insurance companies no longer are required to disclose the liability limits of their insured before a lawsuit is filed.

Plaintiff’s personal injury attorney Bob Massi is upset and suggests that this change will result in an increase in the number of law suits being filed.

FOX5 Vegas – KVVU

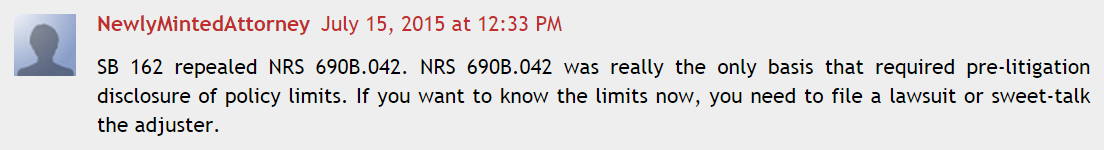

Mr. Massi is not alone in his criticism. Comments made in a discussion on the Las Vegas Law Blog indicate that while some agree with Mr. Massi, others do not.

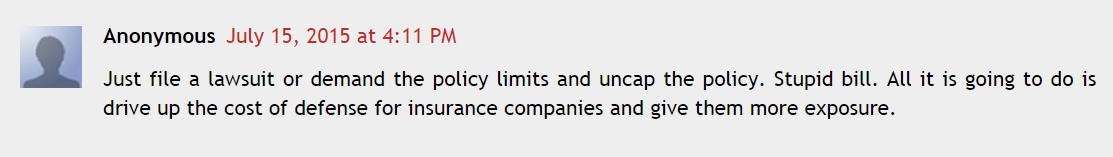

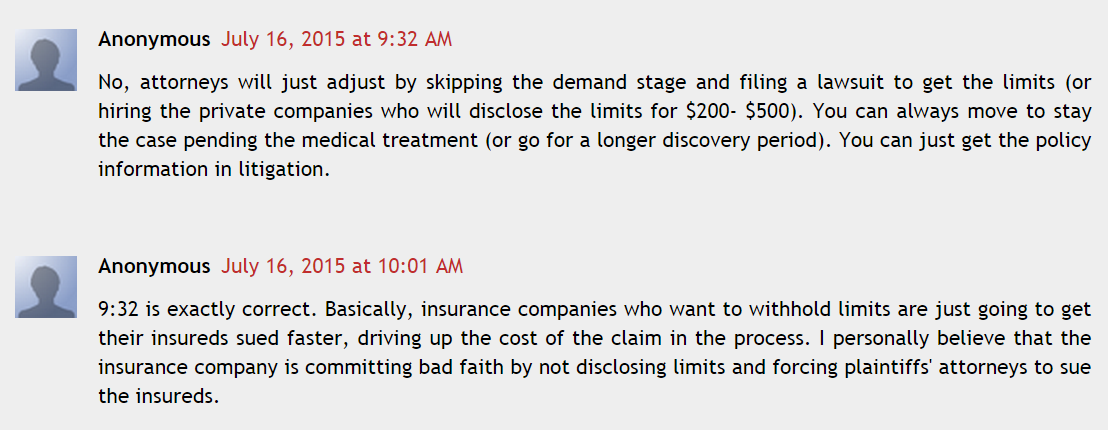

Everyone agrees that the insurance company will have to disclose the policy limit once litigation is filed. Some commenters feel that it will be a risk for insurance companies not to do so.

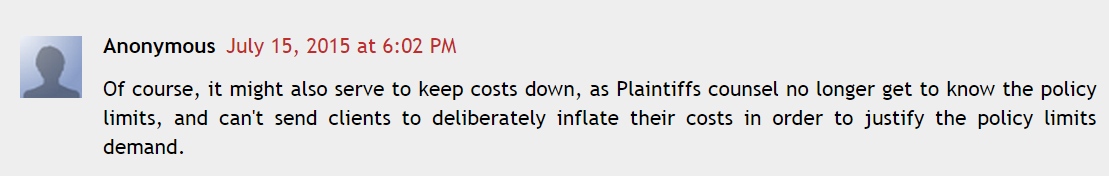

However, others see things in a different light.

Only time will tell how this change will affect the practice of law. However, Mr. Massi is incorrect in intimating that the insurance companies acted nefariously in making this change. The Nevada Legislature does not work like that. The legislature worked for weeks on this bill with public hearings, amendments and votes along the way. The Nevada Justice Association, lobbyists for the Plaintiff’s bar, had representatives at the legislature all through the session. These lobbyists were part of process. The arguments made by Mr. Massi and other Plaintiff’s attorneys did not win the day. The law was repealed.

Now, it will be the job of the Plaintiff’s attorneys to convince the insurance company why it would be in the best interest of their insured to release the policy limits even though the law does not require it. There may be reasons and the company will need to consider those reasons as it makes its decision whether to disclose. The company may have to consult and gain approval of the insured before the release is done.

If you have questions about whether your company should disclose its insured’s policy limit to an injured claimant, please call Mike Mills at 702-240-6060×114 or email him at mike@mcmillslaw.com.

Follow

Follow Email

Email